Managing your finances effectively is crucial for achieving financial stability and reaching your goals. At Cabrillo Credit Union, we understand the importance of sound financial planning. In this guide, we'll show you how to use a personal loan as a budgeting tool to gain better control of your financial life.

Benefits of Using a Personal Loan for Budgeting

Personal loans can be valuable tools for creating and maintaining a well-structured budget. Here's how they can benefit you:

- Consolidating Debt: If you have multiple high-interest debts, such as credit card balances, consolidating them with a personal loan can simplify your financial obligations and potentially reduce your interest costs.

- Fixed Monthly Payments: Personal loans come with fixed monthly payments, making it easier to budget for your expenses. You'll know exactly how much you need to allocate towards repayment each month.

- Lower Interest Rates: By securing a personal loan with a lower interest rate than your existing debts, you can save money over time. This frees up funds for other essential expenses.

- Clear Debt Payoff Timeline: With a personal loan, you'll have a clear and defined timeline for debt repayment. This goal-oriented approach helps you stay focused on becoming debt-free.

Steps to Budgeting with a Personal Loan

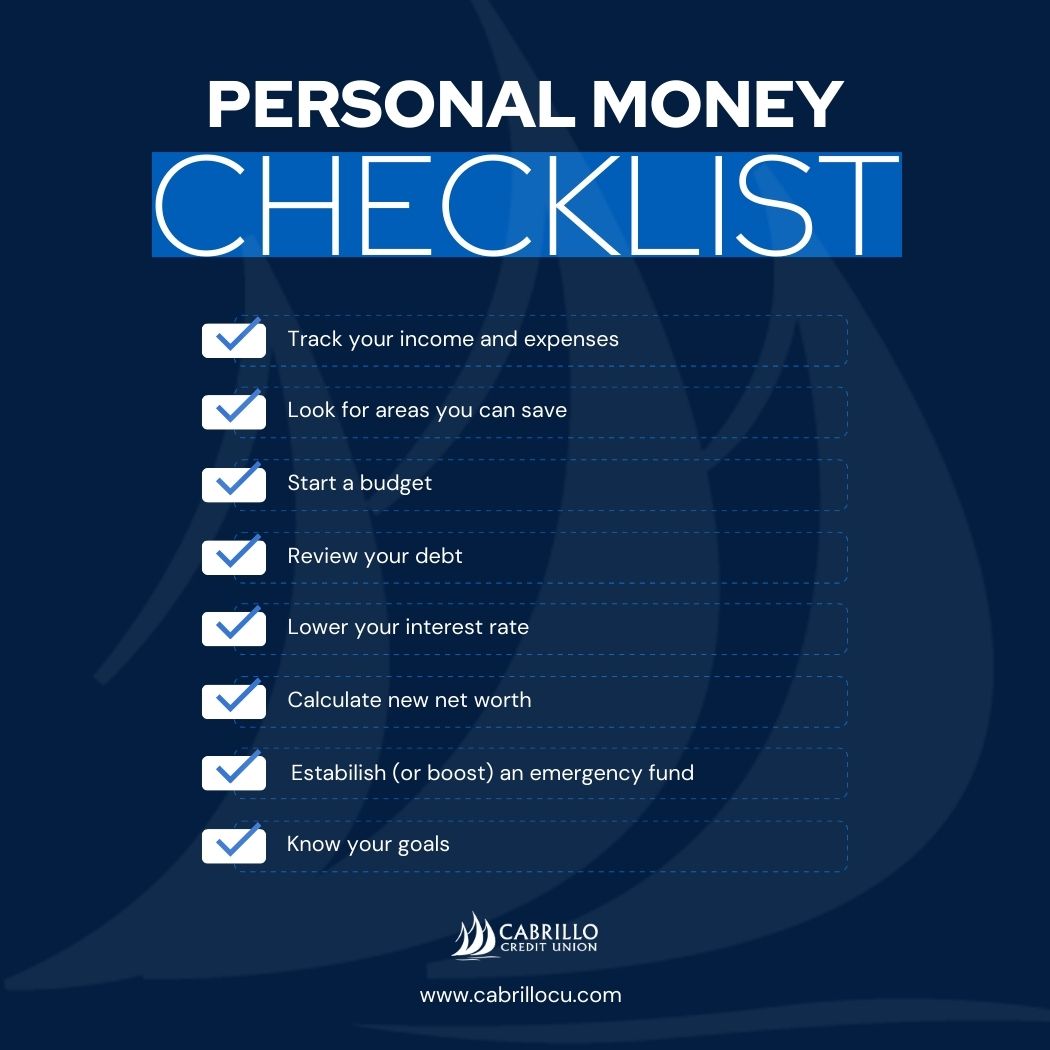

Follow these steps to effectively integrate a personal loan into your budget:

- Evaluate Your Finances: Begin by assessing your current financial situation. Calculate your income, expenses, and outstanding debts to gain a clear overview.

- Set Clear Goals: Define your financial goals, such as debt repayment timelines, savings targets, or major expenses you want to cover with the loan.

- Apply for a Personal Loan: Visit Cabrillo Credit Union to explore our personal loan options. Select a loan with terms that align with your budgeting goals.

- Consolidate High-Interest Debt: If applicable, use the loan to consolidate high-interest debts. This can lower your overall interest costs and simplify your debt management.

- Create a Budget: Develop a comprehensive budget that includes all income sources, monthly expenses, and your personal loan payment. Ensure your expenses do not exceed your income.

- Stick to Your Budget: Discipline is key to budgeting success. Adhere to your budget and prioritize timely loan payments to achieve your financial objectives.

- Monitor Your Progress: Regularly review your budget and financial goals. Adjust your plan as needed to stay on track.

Our personal loans are designed to provide you with the flexibility and support you need to take control of your finances. If you're ready to start budgeting effectively with a personal loan, reach out to us today, and let's embark on this journey towards financial success together.